About BitMEX

- Ease of deposits and withdrawls

- KYC/AML procedures

- The buying and selling process

- Overall ease of use

BitMEX Overview

BitMEX was created by a selection of finance, trading, and web-development experts. Arthur Hayes, Ben Delo, and Samuel Reed launched the exchange in 2014, under their company HDR (Hayes, Delo, Reed) Global Trading Ltd. It is currently registered in Victoria, Seychelles.

BitMEX is a cryptocurrency exchange that focuses primarily on derivatives products, which allow users to speculate on the price of cryptos with high leverage. Although it also provides spot markets, the range of supported assets is currently small compared to competitors.

The exchange became most popular for its derivatives products – most notably its Bitcoin perpetual swaps, collateralized with Bitcoin and accompanied by up to 100x leverage.

BitMEX Services

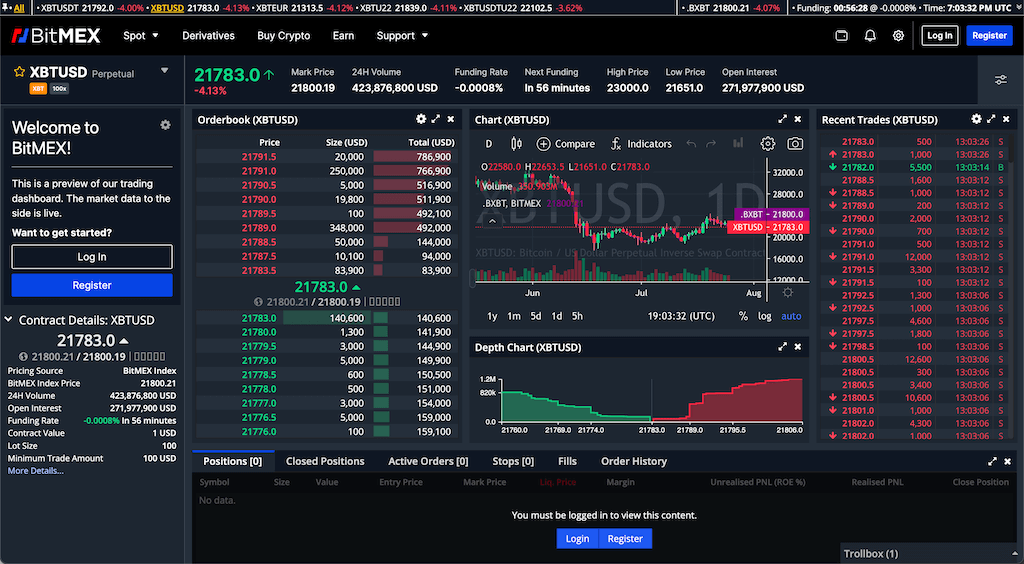

Derivatives Trading

Derivatives products are BitMEX’s claim to fame, featuring both perpetual swap contracts and quarterly futures contracts. These don’t involve directly trading cryptocurrencies; rather, you trade contracts that track the price of a certain cryptocurrency asset.

Perpetual swaps are the most popular product on the exchange, providing traders with contracts that track the price of the underlying crypto asset with no expiry. These are available for a range of different cryptocurrencies, with up to 100x leverage on some contracts.

BitMEX also offers more standard futures contracts, which are settled on a quarterly basis. These have specific expiry dates, at which all open positions are automatically settled at the market price of the underlying asset.

All derivatives contracts on BitMEX are collateralized and settled in BTC or USDT, depending on the instrument at hand.

This type of trading is very volatile, for better and for worse. It means you can generate large profits with small amounts of money, but it also means you can lose everything you’ve invested relatively quickly.

If all this sounds very confusing to you, it probably means you shouldn’t use BitMEX since this type of leveraged derivative trading is aimed mostly for experienced traders.

Spot Trading

In May 2022, BitMEX added a spot trading feature to the platform, for the first time enabling their users to buy and sell cryptocurrencies, rather than just speculate on their prices.

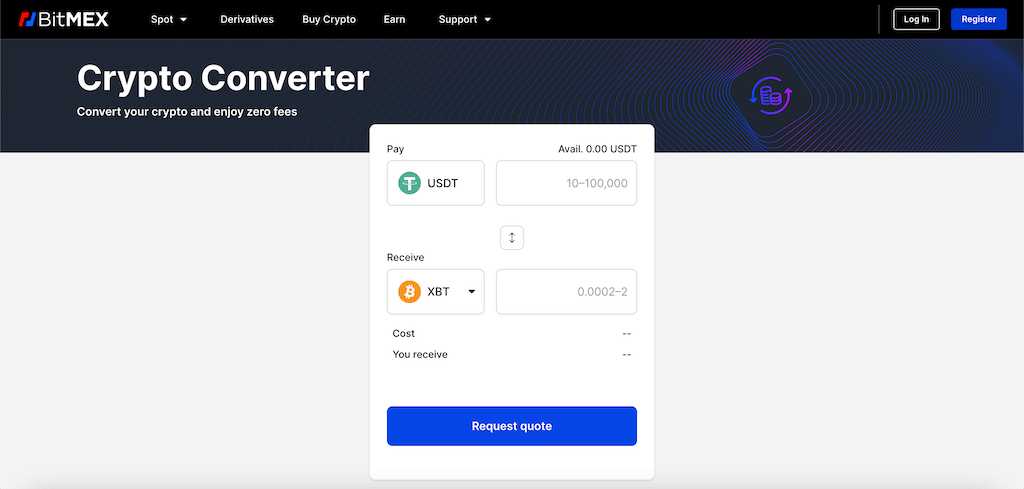

Spot trading on BitMEX is still limited to a handful of popular cryptocurrencies, all currently in USDT trading pairs. Two different interfaces are available for traders on the platform:

- The default spot trading interface, complete with candlestick charts, order books and a complete advanced trading experience.

- A “convert” interface, which allows users to swap between any two supported cryptocurrencies at the going market rate. The convert feature is simple and beginner-friendly, with none of the advanced exchange features from the default spot trading interface.

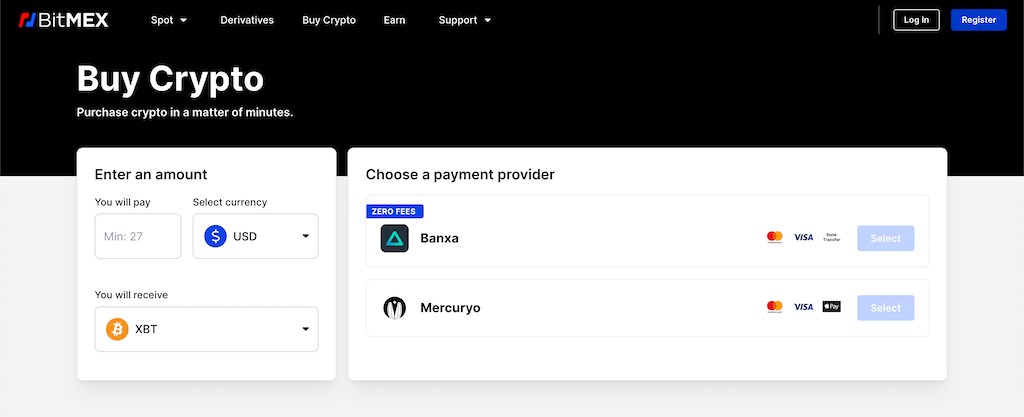

Instant Crypto Purchases

To complement its spot trading features, BitMEX has also added an instant purchase option that provides users with a fiat gateway onto the platform.

This feature is facilitated using third-party payment processors Banxa and Mercuryo, both of which allow customers to purchase cryptocurrency using any Mastercard or Visa bank card. Bank transfer and Apple Pay options are also available through these providers.

BitMEX Earn

Like many of its competitors, BitMEX also provides a yield-bearing feature called BitMEX Earn. This service enables users to deposit their crypto assets for fixed periods of time, earning a certain rate of return. The exchange does not appear to disclose how it generates yields on these deposits, however it is probably safe to assume they are lent to institutional borrowers with interest.

All deposits in BitMEX earn are Insured by the BitMEX insurance fund.

BitMEX Fees

Derivatives

Fees are very competitive on BitMEX. In fact, most users will find them almost negligible relative to the chunky profits to be made if you’re a savvy operator.

The taker fees start at 0.075% and decrease as your 30-day trading volume increases, the highest volume traders only get charged 0.025% on trades. Makers get a rebate of 0.01% on each trade.

It is also important to consider the funding rate on perpetual swap contracts, which is a variable fee (or rebate) which is designed to keep the contract price in line with the underlying asset. This can be positive or negative depending on whether you have taken a long or short position, as well as whether the contract price is above or below the spot price of the underlying asset.

Check out the full fee schedule for derivatives products here.

Spot Trading

Spot trading fees begin at 0.1% for both maker and taker orders, which is highly competitive. These fees decrease for users with higher trading volumes and can reach as low as 0.03% for taker orders and 0.00% for maker orders, for traders in the highest volume bracket.

Fees can be reduced further for BMEX token stakers, depending on the quantity of BMEX staked.

A complete overview of spot trading fees can be viewed here.

Deposits and Withdrawals

Deposits and withdrawals on BitMEX continue to be free of charge, which is always very pleasing—you shouldn’t be left with any hidden costs once you’re done trading (other than the network fees).

BitMEX Customer Support

Customer support

Support is offered via an email ticket, which is pretty standard for the industry. Simple inquiries and issues can be resolved by BitMEX staff in the “Trollbox”, a public chatbox where traders can also chat with each other. While this may not be a direct line to BitMEX, it’s still really cool to be able to interact with other Bitcoin traders from within the exchange.

Aside from email tickets and the “Trollbox” you can also contact BitMEX using their social media channels or through their discord server which has a dedicated support channel. The really nice aspect of the service is the website itself, which is packed full of useful information and features. The support center gives a slick rundown of the exchange and helps educate users on complex trades.

Live updates fill the site too. An announcement box keeps users up to date with any updates and issues.

Security information is loaded into the website, which is always a must for me when I’m looking at a new exchange. With BitMEX, you can quickly find out who owns the platform and how they’re keeping funds secure.

Frequently Asked Questions

Can US Customers Use BitMEX?

BitMEX states they do not accept US traders in their terms of service. BitMEX recently updated their terms and conditions so they require all customers to provide photo ID, proof of address and selfie.

Is BitMEX a Legal Company?

Yes. BitMEX is wholly owned by HDR Global Trading Limited. HDR Global Trading Limited. The company was incorporated under the International Business Companies Act of 1994 of the Republic of Seychelles with a company number of 148707. It is worth noting however that whilst the company is legal and registered the exchange itself is unregulated and its founders have been found guilty of violating the Bank Secrecy Act in the US.

Conclusion

If you know what you’re doing and want a market-leading cryptocurrency derivatives trading platform, then BitMEX is a great choice for you. For those looking for a more simple exchange to buy and sell some Bitcoin, I suggest you look into some other more user-friendly options.

The BitMEX team have used their financial and web-development experience to create a slick platform that allows smooth trading while keeping users informed.